Would you like to work from this place for the rest of your life?

I am certain it’s a loud YES.

I know what you are wondering…only CEO’s and super rich people can afford to work like this not the aam investor.

But what if I said this is possible for common men like you and me. Wouldn’t you like to know more about it?

If your answer is yes. Then you are at the right spot. Read on…

Any business requires atleast three key factors to operate: Land, Labour and Capital.

A business needs land to setup factories, shops, warehouses or offices. You also need labour to man these units. Last but not the least is capital. Although interest rates are low everyone doesn’t get cheap capital from banks to setup their businesses.

Now compare this with the business of intraday trading. You don’t need land or labour to run this business. You only need capital.

Your capital is blocked for a longer duration in all other forms of business. But when you are day trading your capital is blocked only during market hours.

I know a couple of friends who are always chasing their clients to clear outstanding dues. This is their biggest headache. But you must not deal with this if you are a day trader. Isn’t that awesome?

That’s not all.

You don’t have a nagging boss to report to.

You don’t have clients to pursue for sales.

You can work from anywhere you want…beaches, mountains, your bedroom or balcony.

You can work anytime you want.

What more can you ask for? I believe intraday trading is certainly the best business.

But if everything is so good then why isn’t everyone doing day trading?

The only thing that stops people from choosing day trading as a business is MINDSET.

Do You Have the Right Mindset?

Only a few people have the correct mindset to be a successful day trader. Most people think day trading is a get rich quick scheme. But it is far from that.

If you want to be successful at trading then you must treat it just like any other business. Unfortunately, many people don’t think like that and eventually end up losing in the market.

Now let us understand what determines success in a business. If a business is able to push up sales and keep costs low then overall profitability increases. If it does this regularly over a long period then it will be successful.

Now let’s have a look at the profit and loss statement (P&L) of both these businesses below.

| Profit and Loss Statement of a traditional business | Amount (in Rs) | Profit and Loss Statement of a trading business | Amount (in Rs) |

| Sales | XXX | Profits from winning trades | XXX |

| Cost of goods sold | XX | Losses from losing trades | XX |

| Gross Profit | XXX | Gross Profit | XXX |

| Operating expenses and taxes | XX | Brokerage and taxes | XX |

| Net Profit | XX | Net Profit | XX |

You will notice the format of P&L statement of a traditional business on the left. A trading business also has a similar format. Let’s understand it in detail.

Every business relies on sales and focuses on increasing it daily. Just like sales are important for any normal business. Profits from winning trades are also important in trading. Every trader’s goal is to increase profits daily.

Cost of goods sold is the next element in the P&L statement. If a company is in the business of manufacturing garments then it cannot produce them without textile, needles, machinery etc.

Similarly, a trading business cannot operate without losses from losing trades. They are just like any normal expense a business incurs to run it.

But a lot of traders don’t accept this. They believe it is important to make money on every trade. This isn’t possible. If anyone says its possible then he is fooling you. Better keep social distance from him for your health.

When you deduct cost of goods sold from sales you get gross profit. Similarly, when you deduct losses from losing trades with profits from winning trades you get gross profit.

This isn’t your final profit because you also have to pay other operating expenses and taxes. Once you deduct them you get net profit.

Similarly, you also pay brokerage and other taxes in your trading business. Although these expenses are small compared to the losses from losing trades. But you must ensure they don’t eat up a major portion of your profits.

Brokerage is a major expense amongst these expenses. But with Samco’s demat and trading account at your disposal you can rest assure that these costs will be lowest in the industry.

So that’s how you must treat trading…just like any other business. You must take care of brokerage and other taxes by opening an account with Samco. Then the only thing you must focus on is to increase your profits from winning trades and keep losses from losing trades to the minimum.

But keeping losses to the minimum doesn’t mean you can avoid them completely. Like I said earlier, losses are the cost of staying in trading business.

You Don’t Need to be Profitable on Each Trade

Now let’s understand why its not at all important to make money on each trade with an example. Let’s assume you take 10 trades based on a strategy. The winning ratio of this strategy is only 50%. This means that only 5 out of these 10 trades will be profitable.

But here’s the thing…your reward to risk ratio is 2:1. This means you make a profit of two rupees when you win but lose only one rupee on losing trades.

Here’s the total profit that you will make on this strategy.

| Trade | Outcome | Profit (in Rs) |

| Trade #1 | Win | 2 |

| Trade #2 | Win | 2 |

| Trade #3 | Lose | -1 |

| Trade #4 | Win | 2 |

| Trade #5 | Lose | -1 |

| Trade #6 | Lose | -1 |

| Trade #7 | Lose | -1 |

| Trade #8 | Win | 2 |

| Trade #9 | Win | 2 |

| Trade #10 | Lose | -1 |

| Total Profit | 5 |

Despite an accuracy of 50% you still end up with a total profit of Rs 5. Isn’t that great?

A lot of people unnecessarily fixate upon the winning or accuracy ratio. But they should instead focus on reward to risk ratio. They must improve the reward they get for each unit of risk taken.

Ultimately, what matters is not whether you are right or wrong. But how much profit you make when you are right and how much you lose when you are wrong.

Only a few percentage of traders have such kind of mindset and focus on the right things. Hence you don’t find lot of people taking day trading as business.

Trading Made Easy and Profitable

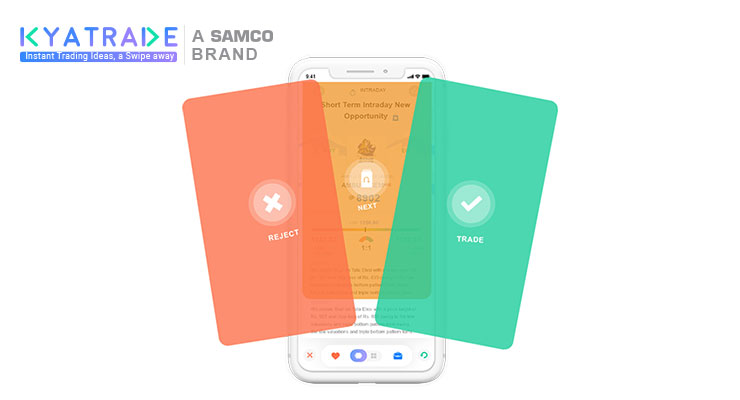

But Samco has decided to change this with our latest offering KyaTrade. It is a platform which offers fresh intraday trading and investment ideas during market hours. It is built with the same principles I just wrote to you earlier.

The key focus is to offer traders a definite strategy with proper entry and exit plan. Traders get well-researched trading ideas with proper risk management. So, you can trade with discipline. And the best apart about KyaTrade is that it is absolutely simple to use. It’s so easy that even this kid could use it.

Don’t believe me just check this. All you got to do to execute a trade is swipe right. You must swipe left to reject a trade. And swipe up to see the next trade.

Simple, isn’t it?

All trades come with pre-filled bracket orders. So, you must not worry about targets or stoplosses. Just chill and trade all the valid opportunities that you see on the screen.

Setting up a intraday trading business was never so simple. All you got to do is open a free demat and trading account with Samco. Then sign-up to the KyaTrade subscription service which costs only Rs 18,000 annually. This is a throw-away price considering immense profit potential the platform has for you.

But to make it even more exciting for you we are giving a full year subscription for 50% discount but only for a limited period. So, you pay only Rs 9,000 for a full year of excellent intraday trading ideas.

I know some people might be skeptical to try this never heard before kind of service. We understand your concerns. Therefore, you can try a month’s subscription for just Re 1.

Yes, you read that right. One rupee is all you must pay to try this service for the first month.

It can’t get any better than this.

Now we have done everything in our control to ensure you get the maximum benefit of this. You must now take the first step and signup to KyaTrade and setup your own profitable intraday trading business.

Leave A Comment?